Start Growing your Money through Equity Crowdfunding

Rōnin Team on aprilie 4th, 2022 / Investing Insights / 8 min read

Starting slowly, even with a small amount of money, you can begin establishing the habit of investing regularly, which hopefully leads to a giant nest in the future. Even small moves can lead to consistent growth.

The investment culture seems like an abstract and intimidating concept for several reasons. There are many specific terms, tax implications, planning, and investment decisions. But by understanding the basics, you can start to flourish. Corbin Blackwell, CFP, the senior financial planner at Betterment Wealth Management, says: „Investing is one of the best ways to grow your long-term wealth and reach major goals for retirement, buying a home, and college funds.”

The awareness and adaptation of crowdfunding worldwide have increased significantly in recent years. According to World Bank forecasts, crowdfunding could reach 90 billion between 2020 and 2025. Not surprisingly, if we look at the trends of start-ups and investors who have begun to consider crowdfunding as an alternative to raise money or invest. Start-up financing is no longer a privilege of venture capital funds or people with significant wealth but has become available to most people.

What Is Equity Crowdfunding?

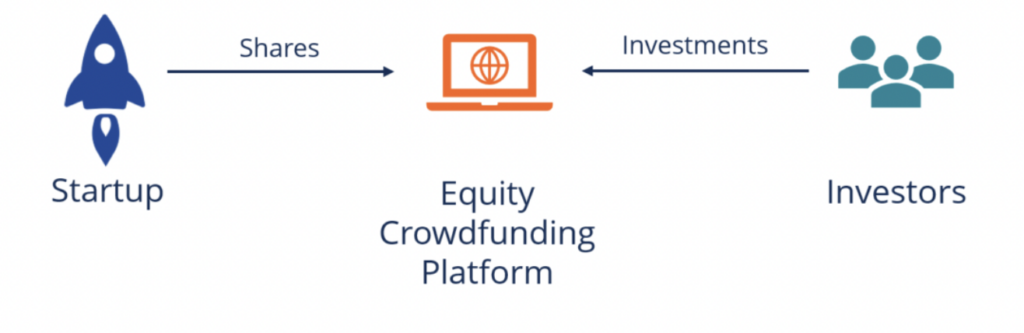

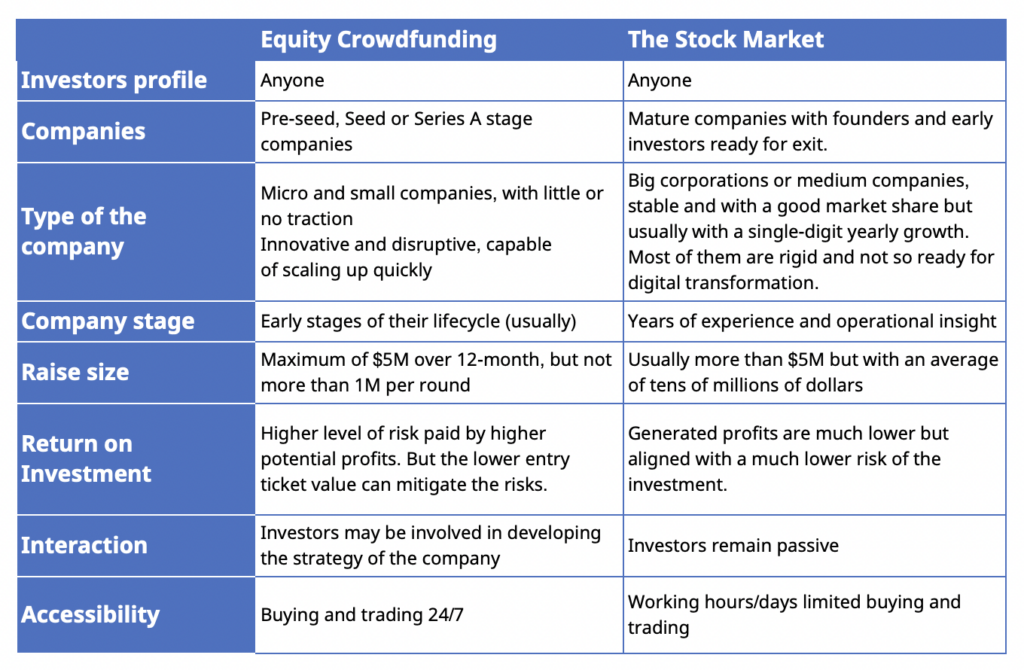

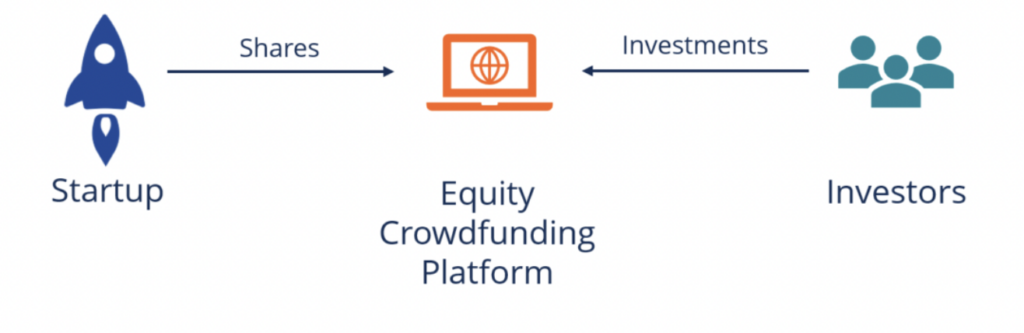

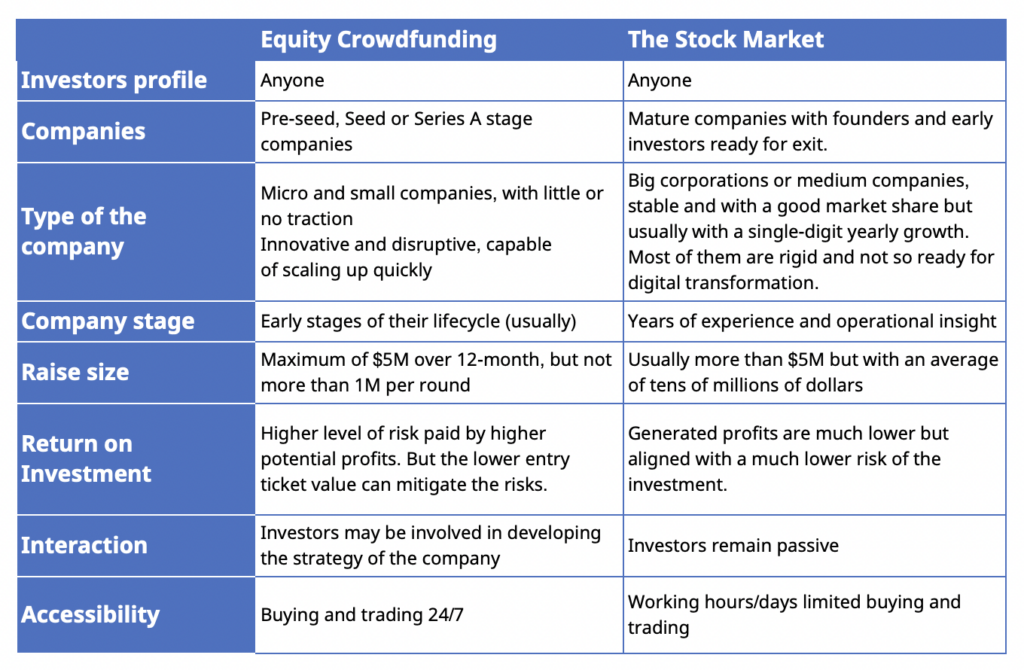

A simple definition for equity crowdfunding can sound like this: this is a method of raising capital from crowd investors to finance a private business. Investors receive an ownership stake of the company in exchange for money. Equity crowdfunding usually takes place on online platforms, where companies create a complete profile in order to run a fundraising campaign, including their arguments and financial statements, among other information about the company. Let’s look at two investment options: equity crowdfunding and stock market, and see what the differences are between them.

Is Equity Crowdfunding Legal?

Yes, it’s legal. In the United States, the law passed by the US Securities and Exchange Commission supports private companies to raise up to $5 million over 1 year through equity funds. Accredited investors can make investments – they must meet the requirements related to assets, income, jobs – or consumers – family, friends, business partners.

As for the European Union, the Regulation on European Business Participation Providers (ECSPs) entered into force on 10 November 2020. After 12 months of transition, the regulation came with uniform crowdfunding rules applicable across the EU for investment and lending crowdfunding service providers in corporate financing. This allows platforms to apply for an EU passport based on rules. This EU passport offers the possibility to provide services under a single authorization.

What are the risks of Equity Crowdfunding?

Before getting involved in equity crowdfunding activities, find out and be aware of its risks:

1. Equity Dilution

A simple definition of this refers to reducing the private equity of shareholders. The value of a company increases every time investments come from an external entity. The number of quotas issued increases, but the number of shares held by the initial investors remains the same, and the percentage of their holdings in the company is reduced.

2. High risk of failure

Studies show that 90% of start-ups fail. The risk of investing through equity crowdfunding in a start-up is directly proportional to its failure rate. Even profitable businesses can fail miserably without a well-developed plan and support strategy.

3. Low liquidity

As with venture capital, crowdfunding investors can wait a long time for the return on investment since securities purchased through equity crowdfunding cannot be quickly converted into cash.

4. Risk of fraud

As accessible as online platforms and social networks are for crowdfunding, it is an accessible environment for scams. Don’t leave second due diligence for any investment.

Equity Crowdfunding – European Landscape

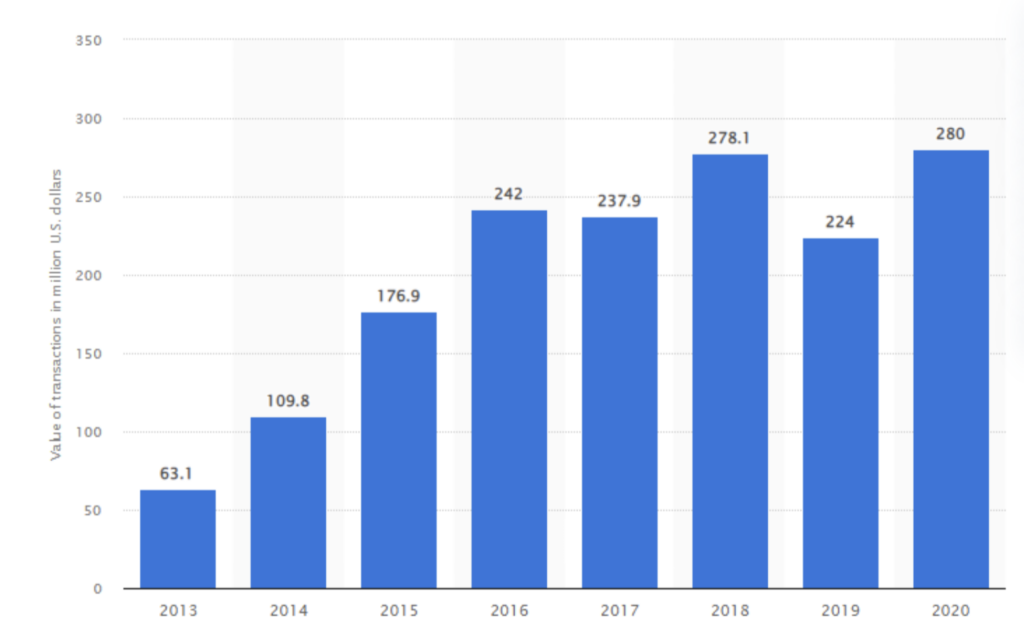

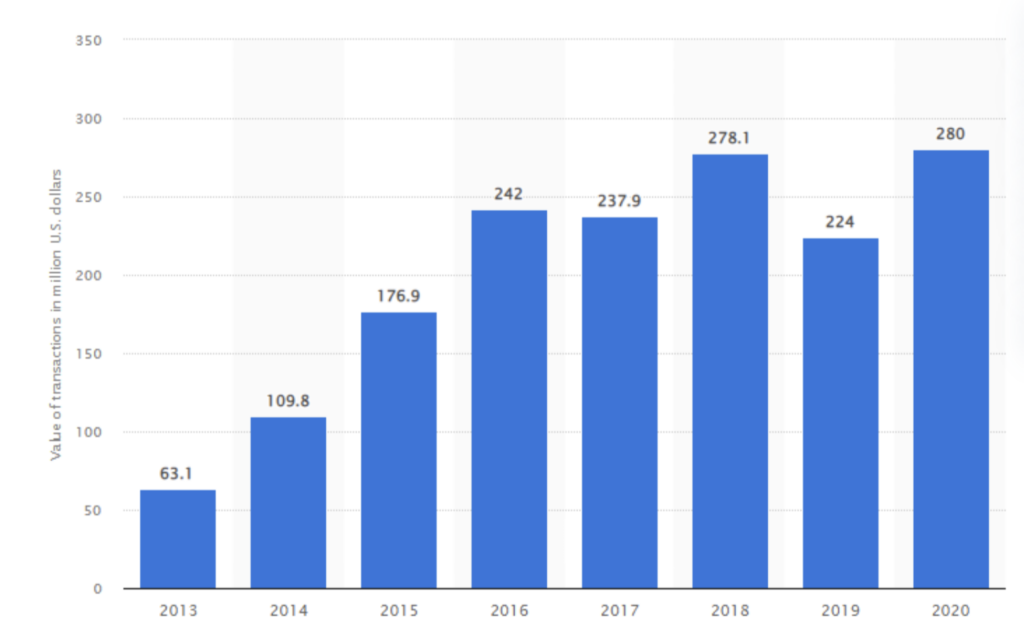

Let’s take a look at the European landscape regarding Equity Crowdfunding. As you can see in the chart below, there has been a significant increase in recent years.

From 2013, there has been an exponential increase in transaction value in Europe (excluding the UK). The Regulation on European Crowdfunding Service Providers for business (ECSP, 2020/1503/EU) has created a well-harmonized regime for financial-return crowdfunding ecosystems. For the first time in Europe, investors from all EU member states can invest in companies with potential.

It is expected that in the next five years, ECPS laws and regulations will encourage crowdfunding investment behavior and will ensure the integration of crowdfunding as a core component in the EU. Yay! This comes with an extraordinary thing – stimulating collaborative work between state institutions and crowdfunding platforms. In addition to private and public funds, European funds will be added to crowdfunding platforms. However, crowdfunding is becoming more and more popular, but we have to remember: 90% of startups fail in their first year of operation.

If the public wants to support startups, they must also be prepared to lose money. A report commissioned by the British Business Angels Association and NESTA found that even the most experienced entrepreneurs often finance their acquisitions by investing in a well-rounded portfolio of startups, with nearly 40% of them losing money overall. It happens.

Taking a step back on the impact of the COVID-19 pandemic, crowdfunding was very agile during this period, coming in a very short time with new business models and support for projects and companies. The global pandemic has brought increased attention and involvement in the crowdfunding market. Donation and reward crowdfunding has seen a huge increase during the COVID-19 crisis, and this creates the expectation that they will continue an upward trend.

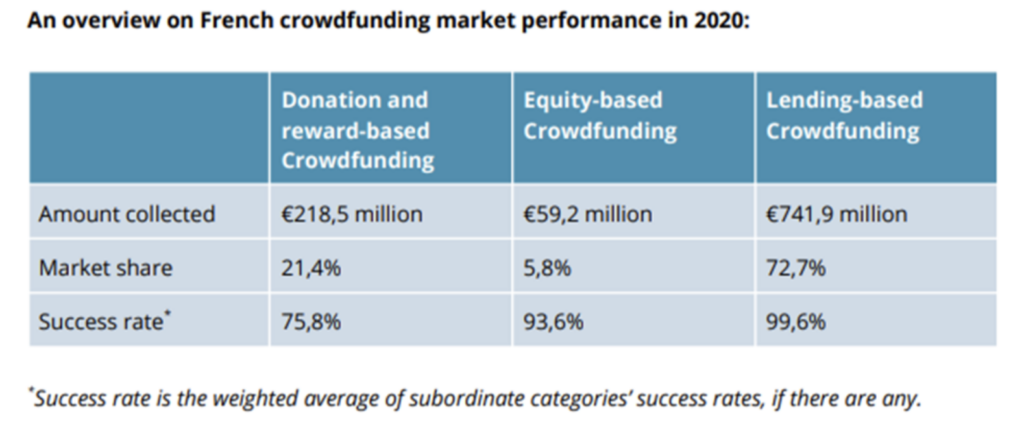

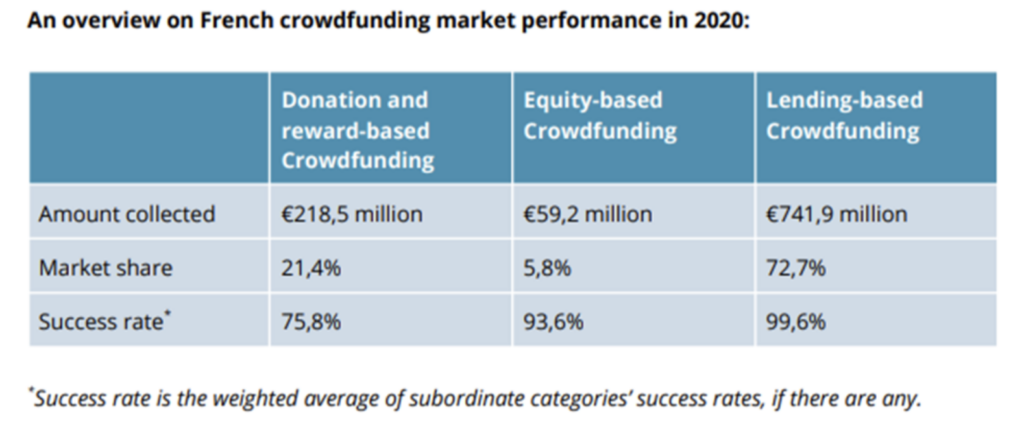

For example, France’s crowdfunding market in 2020 had an increase of 62.2% as compared to 2019. Below you can find the figures for 2020:

Another good-case practice example is Italy, which has seen a massive increase to 101.8 million as compared to 73.7 million in 2019. 595 campaigns were financed by 42 Italian platforms that are dedicated to equity-based crowdfunding, insights taken from the report „Current State of Alternative Finance in Europe 2021„.

The Romanian investment ecosystem also brings promising prospects. Such is the example of Rōnin platform, which advocates for the democratization of entrepreneurs’ access to capital and investment for all. If you’re eager to start investing, you can explore ongoing campaigns here.

The Benefits of Equity Crowdfunding for Investors

Look at equity crowdfunding as an alternative to nurture and feed your income, especially if you choose a start-up with high growth potential. Let’s say that with just €100 you can:

- have the opportunity to become an investor and start growing your money the wise way;

- gain top or high capitalization over a project you believe in;

- have a greater personal satisfaction about your financial growth;

- have the opportunity to stimulate the local and national economy by supporting new businesses and creating more jobs;

- unleash your rōnin spirit and become a true believer and supporter for the eager entrepreneurs who want to bring an impact in the world.

Who can Invest?

Anyone! Yes, you read correctly. Until recently, only wealthy people, angel investors, venture capitalists, and professional investors could invest in a startup. Equity crowdfunding portals aimed to democratize the investment process, giving access to a larger mass of investors.

Equity crowdfunding takes place online on equity investment platforms, which offers unique investment opportunities accessible to all who are willing to start even with a small amount to invest. Each equity investment platform has its investment criteria.

For example, on the Rōnin platform, literally, anyone aged 18 and over can start investing with an amount of €100. All listed companies have gone through a due diligence process. Integration is simple, completely digital, and does not involve initial investment fees. Moreover, the investors will soon be able to sell the shares on the secondary market available on weronin.com.

The Bottom Line

Equity Crowdfunding is an „unconventional”, yet attractive and rewarding way to increase your income; at the same time, for a company, it can raise funds necessary for growth by requesting a more significant number of supporters to invest a small amount.

Moreover, Equity Crowdfunding creates a perfect framework for investors and entrepreneurs to get together and work together through an alternative investments platform, which builds momentum and takes a shared vision to the next level.

Eager to start investing with little money? Come have a look at the campaigns currently running on weronin.com. As mentioned above, the Rōnin community’s mission is to give everyone access to private equity investments and facilitate a relationship between entrepreneurs and potential crowd investors. With a low investment threshold of €100, Rōnin wants to enable „the real crowd” of retail investors. This amount will allow you to diversify your portfolio and also reduce risk significantly by supporting more than one project. Thus, any company or citizen of Europe or a country in the European Economic Area can invest through Rōnin in the companies they want to support.

––––––––––––––––––-

FAQs

What are the four types of crowdfunding?

There are four types of crowdfunding:

- Debt Crowdfunding – means raising money that you will return;

- Equity Crowdfunding – involves giving equity investors in a company;

- Reward-based Crowdfunding – consists in providing incentives to investors in return for the investment;

- Donor Crowdfunding – investing in the company involves a donation without the involvement of giving incentives or giving back the money.

How does Equity crowdfunding differ from other types of crowdfunding?

The Equity-based crowdfunding models return to an investor a shareholding, which grants him partial ownership of the company.

What is an Equity platform?

An Equity Crowdfunding platform brings together the private company that needs the financing and the „crowd” interested in investing in it. Also, on the platform, companies create their profiles, pitch their ideas, put evidence and financial reports, etc.

How do I start investing through an equity crowdfunding platform?

If investing sounds like a hassle, equity crowdfunding might be your solution to start growing your money. Besides the failure risks, equity platforms offer great potential for huge returns, and also the idea of supporting bold ideas and startups to succeed. The process of enrolling on an equity platform is usually frictionless, so you can be exposed to startup campaigns with strict due diligence. For example, we have explained how you can become a real investor right now, with little as €100 on the Rōnin platform.

Step 1: Sign up or log in on weronin.com

Step 2: Choose the campaign you want to support

Step 3: Select the number of tickets you want to invest in & commit your investment

Step 4: Verify your identity (if you haven’t done it yet)

Step 5: Sign the Investor Agreement and proceed with the payment. More instructions will follow.

Not a rōnin yet?

Join us

Start Growing your Money through Equity Crowdfunding

Rōnin Team on aprilie 4th, 2022 / Investing Insights, Investor Resources / 8 min read

Starting slowly, even with a small amount of money, you can begin establishing the habit of investing regularly, which hopefully leads to a giant nest in the future. Even small moves can lead to consistent growth.

The investment culture seems like an abstract and intimidating concept for several reasons. There are many specific terms, tax implications, planning, and investment decisions. But by understanding the basics, you can start to flourish. Corbin Blackwell, CFP, the senior financial planner at Betterment Wealth Management, says: „Investing is one of the best ways to grow your long-term wealth and reach major goals for retirement, buying a home, and college funds.”

The awareness and adaptation of crowdfunding worldwide have increased significantly in recent years. According to World Bank forecasts, crowdfunding could reach 90 billion between 2020 and 2025. Not surprisingly, if we look at the trends of start-ups and investors who have begun to consider crowdfunding as an alternative to raise money or invest. Start-up financing is no longer a privilege of venture capital funds or people with significant wealth but has become available to most people.

What Is Equity Crowdfunding?

A simple definition for equity crowdfunding can sound like this: this is a method of raising capital from crowd investors to finance a private business. Investors receive an ownership stake of the company in exchange for money. Equity crowdfunding usually takes place on online platforms, where companies create a complete profile in order to run a fundraising campaign, including their arguments and financial statements, among other information about the company. Let’s look at two investment options: equity crowdfunding and stock market, and see what the differences are between them.

Is Equity Crowdfunding Legal?

Yes, it’s legal. In the United States, the law passed by the US Securities and Exchange Commission supports private companies to raise up to $5 million over 1 year through equity funds. Accredited investors can make investments – they must meet the requirements related to assets, income, jobs – or consumers – family, friends, business partners.

As for the European Union, the Regulation on European Business Participation Providers (ECSPs) entered into force on 10 November 2020. After 12 months of transition, the regulation came with uniform crowdfunding rules applicable across the EU for investment and lending crowdfunding service providers in corporate financing. This allows platforms to apply for an EU passport based on rules. This EU passport offers the possibility to provide services under a single authorization.

What are the risks of Equity Crowdfunding?

Before getting involved in equity crowdfunding activities, find out and be aware of its risks:

1. Equity Dilution

A simple definition of this refers to reducing the private equity of shareholders. The value of a company increases every time investments come from an external entity. The number of quotas issued increases, but the number of shares held by the initial investors remains the same, and the percentage of their holdings in the company is reduced.

2. High risk of failure

Studies show that 90% of start-ups fail. The risk of investing through equity crowdfunding in a start-up is directly proportional to its failure rate. Even profitable businesses can fail miserably without a well-developed plan and support strategy.

3. Low liquidity

As with venture capital, crowdfunding investors can wait a long time for the return on investment since securities purchased through equity crowdfunding cannot be quickly converted into cash.

4. Risk of fraud

As accessible as online platforms and social networks are for crowdfunding, it is an accessible environment for scams. Don’t leave second due diligence for any investment.

Equity Crowdfunding – European Landscape

Let’s take a look at the European landscape regarding Equity Crowdfunding. As you can see in the chart below, there has been a significant increase in recent years.

From 2013, there has been an exponential increase in transaction value in Europe (excluding the UK). The Regulation on European Crowdfunding Service Providers for business (ECSP, 2020/1503/EU) has created a well-harmonized regime for financial-return crowdfunding ecosystems. For the first time in Europe, investors from all EU member states can invest in companies with potential.

It is expected that in the next five years, ECPS laws and regulations will encourage crowdfunding investment behavior and will ensure the integration of crowdfunding as a core component in the EU. Yay! This comes with an extraordinary thing – stimulating collaborative work between state institutions and crowdfunding platforms. In addition to private and public funds, European funds will be added to crowdfunding platforms. However, crowdfunding is becoming more and more popular, but we have to remember: 90% of startups fail in their first year of operation.

If the public wants to support startups, they must also be prepared to lose money. A report commissioned by the British Business Angels Association and NESTA found that even the most experienced entrepreneurs often finance their acquisitions by investing in a well-rounded portfolio of startups, with nearly 40% of them losing money overall. It happens.

Taking a step back on the impact of the COVID-19 pandemic, crowdfunding was very agile during this period, coming in a very short time with new business models and support for projects and companies. The global pandemic has brought increased attention and involvement in the crowdfunding market. Donation and reward crowdfunding has seen a huge increase during the COVID-19 crisis, and this creates the expectation that they will continue an upward trend.

For example, France’s crowdfunding market in 2020 had an increase of 62.2% as compared to 2019. Below you can find the figures for 2020:

Another good-case practice example is Italy, which has seen a massive increase to 101.8 million as compared to 73.7 million in 2019. 595 campaigns were financed by 42 Italian platforms that are dedicated to equity-based crowdfunding, insights taken from the report „Current State of Alternative Finance in Europe 2021„.

The Romanian investment ecosystem also brings promising prospects. Such is the example of Rōnin platform, which advocates for the democratization of entrepreneurs’ access to capital and investment for all. If you’re eager to start investing, you can explore ongoing campaigns here.

The Benefits of Equity Crowdfunding for Investors

Look at equity crowdfunding as an alternative to nurture and feed your income, especially if you choose a start-up with high growth potential. Let’s say that with just €100 you can:

- have the opportunity to become an investor and start growing your money the wise way;

- gain top or high capitalization over a project you believe in;

- have a greater personal satisfaction about your financial growth;

- have the opportunity to stimulate the local and national economy by supporting new businesses and creating more jobs;

- unleash your rōnin spirit and become a true believer and supporter for the eager entrepreneurs who want to bring an impact in the world.

Who can Invest?

Anyone! Yes, you read correctly. Until recently, only wealthy people, angel investors, venture capitalists, and professional investors could invest in a startup. Equity crowdfunding portals aimed to democratize the investment process, giving access to a larger mass of investors.

Equity crowdfunding takes place online on equity investment platforms, which offers unique investment opportunities accessible to all who are willing to start even with a small amount to invest. Each equity investment platform has its investment criteria.

For example, on the Rōnin platform, literally, anyone aged 18 and over can start investing with an amount of €100. All listed companies have gone through a due diligence process. Integration is simple, completely digital, and does not involve initial investment fees. Moreover, the investors will soon be able to sell the shares on the secondary market available on weronin.com.

The Bottom Line

Equity Crowdfunding is an „unconventional”, yet attractive and rewarding way to increase your income; at the same time, for a company, it can raise funds necessary for growth by requesting a more significant number of supporters to invest a small amount.

Moreover, Equity Crowdfunding creates a perfect framework for investors and entrepreneurs to get together and work together through an alternative investments platform, which builds momentum and takes a shared vision to the next level.

Eager to start investing with little money? Come have a look at the campaigns currently running on weronin.com. As mentioned above, the Rōnin community’s mission is to give everyone access to private equity investments and facilitate a relationship between entrepreneurs and potential crowd investors. With a low investment threshold of €100, Rōnin wants to enable „the real crowd” of retail investors. This amount will allow you to diversify your portfolio and also reduce risk significantly by supporting more than one project. Thus, any company or citizen of Europe or a country in the European Economic Area can invest through Rōnin in the companies they want to support.

––––––––––––––––––-

FAQs

What are the four types of crowdfunding?

There are four types of crowdfunding:

- Debt Crowdfunding – means raising money that you will return;

- Equity Crowdfunding – involves giving equity investors in a company;

- Reward-based Crowdfunding – consists in providing incentives to investors in return for the investment;

- Donor Crowdfunding – investing in the company involves a donation without the involvement of giving incentives or giving back the money.

How does Equity crowdfunding differ from other types of crowdfunding?

The Equity-based crowdfunding models return to an investor a shareholding, which grants him partial ownership of the company.

What is an Equity platform?

An Equity Crowdfunding platform brings together the private company that needs the financing and the „crowd” interested in investing in it. Also, on the platform, companies create their profiles, pitch their ideas, put evidence and financial reports, etc.

How do I start investing through an equity crowdfunding platform?

If investing sounds like a hassle, equity crowdfunding might be your solution to start growing your money. Besides the failure risks, equity platforms offer great potential for huge returns, and also the idea of supporting bold ideas and startups to succeed. The process of enrolling on an equity platform is usually frictionless, so you can be exposed to startup campaigns with strict due diligence. For example, we have explained how you can become a real investor right now, with little as €100 on the Rōnin platform.

Step 1: Sign up or log in on weronin.com

Step 2: Choose the campaign you want to support

Step 3: Select the number of tickets you want to invest in & commit your investment

Step 4: Verify your identity (if you haven’t done it yet)

Step 5: Sign the Investor Agreement and proceed with the payment. More instructions will follow.

Not a rōnin yet?

Join usRead more insights

Paving the Path to Sustainable Fashion: Meet Romina, Founder of Dressingz

Andra Costin on iulie 24th, 2023

In times when fashion and technology may seem like two distant worlds, Romina, the founder of Dressingz, saw an opportunity to bridge the gap and create a transformative impact. With a remarkable background in the fast-paced tech and telco industry, Romina's journey took a fascinating turn when she decided to venture into the pre-loved fashion realm.

Introducing ELEC: Redefining Travel for a Sustainable Future

Andra Costin on iulie 11th, 2023

With a focus on sustainability and a vision to redefine travel, ELEC is ready to reshape the way we commute & travel, inspiring a greener and more sustainable world. To uncover the story behind their mission, we sat down with Alexandru Manea, founder and CEO of ELEC.